Analysis: Financial Inequality In European Football

Financial disparity amongst leagues and clubs has been a topic worth discussing for a long time. And the concerning chasm just seems to be increasing in a layered manner.

– The very first layer can be considered to be the increasing gap between the group of ‘big five’ leagues and the rest of top-tier leagues across Europe.

– The second layer lies within the group of five leagues itself. Premier League club’s combined total revenue is almost twice that of the nearest league. In pre-pandemic 2019/20, aggregate Premier League clubs’ revenue was 1.6X that of its nearest league Bundesliga’s aggregate which has subsequently grown to 1.9X in 23/24.

– Last but not the least, the disparity within each league where the aggregate revenue of a group of few clubs is more than half of the total league revenue. For example, six Premier League clubs (need we name them?) combined revenue is almost 57% of the total Premier League revenue in 23/24.

Another astonishing fact that substantiates the disparity is that the combined total of 20 highest revenue generating clubs is almost 55% of the combined revenue generated by the 96 clubs comprising the ‘big five’ leagues!

It’s kind of strange situation that while on one hand it’s becoming difficult for a club from let’s say Ligue 1 to compete with a Premier League club to bid for the services of the same player but at the same time leagues like Ligue 1 have been very successful in selling players to the Premier League clubs making player sales, a solid and increasing source of revenue.

This blog examines the financial disparity between the clubs within leagues at multiple points.

Increasing Gap Between Premier League and Others

Over the last five years, Premier League, buoyed by strong overseas broadcast media deals, has been consistently increasing the gap with the next nearest league. In the pre-pandemic period, their aggregate revenue was almost 1.6X that of Bundesliga, their nearest competitor.

From the 22/23 cycle, Premier League international media rights got a huge boost with a 23% increase in per year value. Almost at the same time, the other leagues were hit by a decrease in the international media rights values which subsequently led to an increase in their revenue gap with Premier League.

Inequality Gap within Leagues

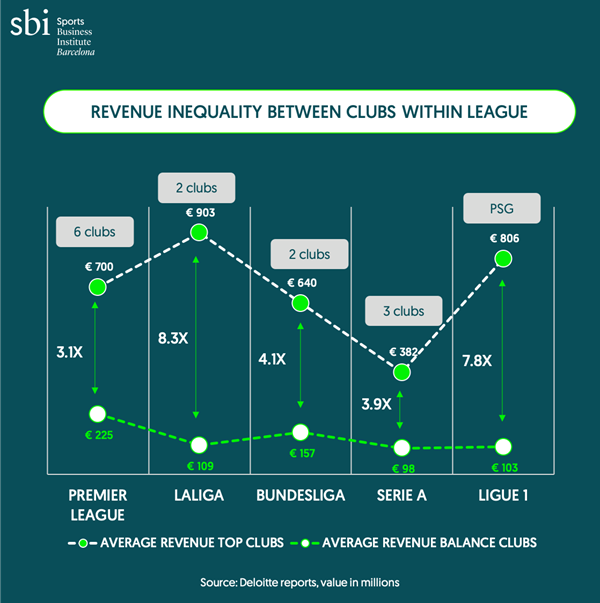

The financial gap between the leagues is another concerning issue making each league become an uneven playing field. A set of clubs in each of the ‘big five’ leagues regularly records revenue far exceeding the other clubs within, thus creating a tiered situation. These clubs have been consistently featured in the Deloitte Football Money League’s list of top 20 clubs with highest revenue.

One can easily list out the ‘big six’ within Premier League, or top two in LaLiga. Similarly, in Bundesliga two clubs stand out. Ligue 1 has been characterised by the increasing dominance of PSG while the rest of the league is way behind. Serie A has a set of four clubs who feature prominently in the list of highest revenue generator, the fourth position oscillating between two clubs.

The difference between average revenue of the set of top clubs and the set of remaining clubs is very stark, as shown in the chart.

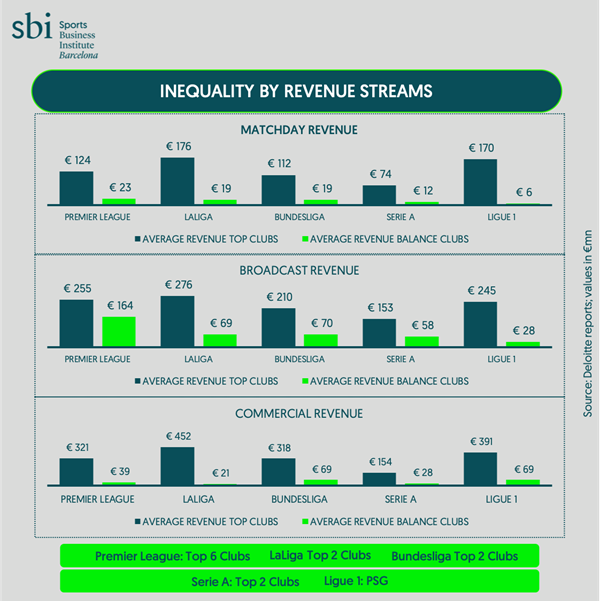

It becomes even more apparent when we further examine by revenue streams, namely matchday, broadcasting and commercial (including sponsorship plus others). The commercial attractiveness of bigger clubs can be attributed to a mix of astute marketing, creating better stadium infrastructure and global fandom.

Further, diversified and financially stronger ownership support and presence of global stars have all contributed to making the appeal stronger for the top clubs. It is also crucial to understand that a greater number of matches affiliated with European competitions played by the top teams leads to a higher matchday income.

Social Media

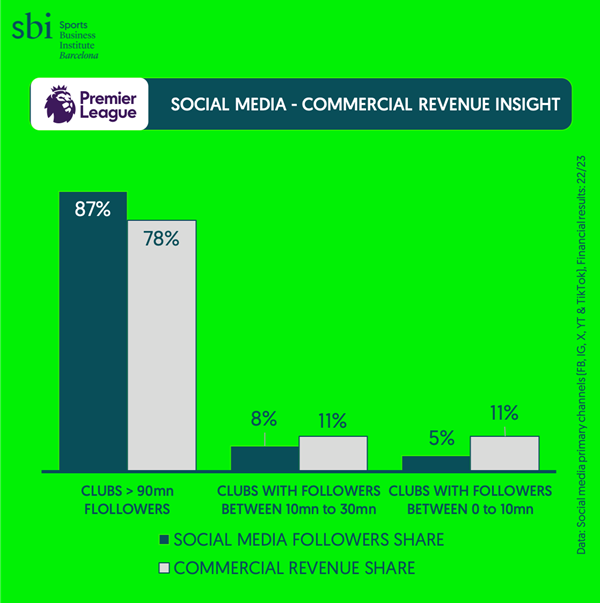

Social media, a mainstay in the digital world for all business and independent entities today, gives a glimpse of the global appeal of the big teams. Taking Premier League as an illustrative example, the 24/25 season teams have 1.03bn combined social media followers. This includes the main pages and channels of Facebook, Instagram. X or Twitter, YouTube and TikTok. Out of this, 87% of followers are of the ‘big six’ clubs and 13% for all other clubs combined. As mentioned above, while the smaller clubs are focused on local support, the bigger clubs count on global support, both in terms of fans and sponsors

Commercial revenue, mainly from sponsorships, of a football club can be generalised as directly proportional to the size of its fan following. As we investigate the revenue share by club, we see a very interesting trend. In a broad scope, clubs with global fan presence attracts bigger brands and subsequently highest financial returns. A club with more concentrated local presence, as a result, attracts attention from the local brands.

To understand this in a better manner, we corelate social media following from teams in Premier League 22/23 season and analyse with their commercial revenue (22/23 season).

Here are the interesting observations

Top 6 clubs, >90m SM followers (87% of total followers) – 78% commercial revenue

Next 5 clubs, 10-30m followers (8% total followers) – 11% revenue

Bottom 9 clubs, <10mn followers (5% total followers) – 11% revenue

In Conclusion

Inequality is evident and the strain is reflected in the club financials. Two questions prevail: Is it a concerning issue? If yes, Is there any solution to ease the pressure? UEFA has been instrumental in pushing the PSR rules strongly, but the key lies within the league themselves as they are self-governed. The solutions will have to be found by the league themselves, but maybe something drastic is required to make a better level-playing field.

Images & Graphs: SBI Barcelona