Foreign Investments In European Football: Slowdown Or Change In Strategy?

The recent takeovers like Sheffield United in the UK and Hellas Verona in Italian football, incidentally both by US-based investors, signal that investor interest in European football is still alive and going strong but can definitely be said that strategy is changed. According to the 2025 UEFA European Club Finance and Investment Report, the number of takeovers almost halved in 2024 with just 23 completed takeovers, a drop of almost 50% from the 44 takeovers completed in 2023.

Does that mean investments are no longer attractive? Not likely, it is just driving a different track noticeably increase in minority investments and a stronger push towards second-division or even lower-tiered clubs.

In this blog, we take a deeper look at the state of foreign investments.

Number of Takeovers

Pandemic changed shape of many industries in the business world and sports is one of them. Before pandemic, it was a rarity to see private capital being utilised in the European football. But the pandemic aftereffects left the clubs, especially smaller ones financially broken and the and the football industry (among other sports leagues) had plunged into an abyss of losses forced by closed stadiums, abandonment of games and so on

This led to the definite need to inject capital and one door led to another making way for the entry of private capital investors who were attracted in the form of minority as well as complete club takeovers. These investors, mostly coming from the USA, have been the dominant force of takeovers that we see today

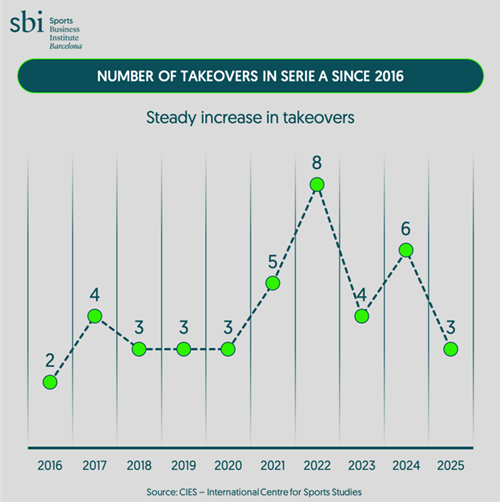

The ‘big five’ leagues were and still are the primary targets of the private capital investors. As per Pitchbook report, more than a third of clubs in Europe’s “Big Five” leagues are now backed by private equity, venture capital or private debt firms, with private ownership in the 2024-2025 season rising to 41.7% from 36.7% just two years ago. The number of takeovers steadily increased 2020-2023 but drastically fell to half in 2024.

Begging the question, why has the takeover train slowed down? The current investment climate points to multiple factors like geo-political and economic situations, reduced availability of attractive clubs, rising interest rates, uncertainty due to promotion/relegation methods, higher valuation demands from sellers and so on which would possibly be the reasons for lower number of takeovers in 2024.

That said, the strategies are now being redefined. The football investment market is seeing two strong trends, one, a breed of smarter, more intentional investors who are better prepared with the reality and two, clubs that fail to maintain financial transparency and sustainability are finding it harder to secure buyers.

In either case, institutional investors are highly likely to have a clear exit strategy and only investors with a long term perspective will remain.

SBI’s Masters in Football Business Management program focuses on extensively on the subject of investments and multi-club ownership having a dedicated module towards it with expert speakers giving real life case studies to illustrate the subject. The 2025-26 edition of the program, beginning in October 2025, has been announced and in case the subject interests you and you’re looking at kickstarting your career growth in the football industry, please look at the program details here: www.sbibarcelona.com

Increasing Interest in Serie A

Italy has always been one of the preferred investment locations in European football. Over the last 5-year period, at least 19 clubs (including Hellas Verona, Genoa etc. have seen change of hands or minor investments). As stated by CIES – International Centre for Sports Studies, clubs from Serie A, Serie B and even Serie C, have consistently been among the most sought-after by international investors in recent years. Further stated, since 2016, they have attracted more than 40 separate foreign investments! With the acquisition of Inter Milan, there are 14 Italian football club under American ownership.

Question is why is Italy becoming the hot destination for football investments? A possible explanation could be the mix of affordability, potential of growth, deep-rooted fandom, rich history and openness of investment factors make Italy a very attractive option. Not discounting the other factors like Italian Serie A is one of the ‘big five leagues’, stadium ownership is still majorly by the local government council and private ownership is just at the cusp of growth and so on.

The other side is the challenges faced by the clubs like resistance of fans to player transfers within group clubs, bureaucratic hassles in stadium ownership, plateauing or dropping media rights revenue. However, with an increasing international ownership presence, one can expect the challenges to be addressed.

Looking at Lower Division Clubs

There is a growing trend of looking at second-tier clubs or even lower division clubs across Europe for an opportune investment. Some success stories like Wrexham (of course!), Como FC etc. have probably fuelled the need to look at these clubs. There could be two possible reason why the lower-division clubs are demanding attention:

– Low cost of acquisition.

– Enormous growth potential.

– Authentic and relatable.

– Increase in valuation if they do well.

It would be fair to say it’s not everyday that a story like Wrexham can be found. Behind its success, there has been a lot of factors, often over-looked like deeply involved management, genuine connect with local fan base, deep pockets (while Wrexham’s reached an astounding £100mn, it is also running at an operating loss) and smart utilization of content (you need master story-tellers like Ryan Reynolds and McElhenney) to say the least.

That said, the interest towards second division clubs in particular have been growing. CIES explains the status of foreign investment in second tier football clubs in a single chart.

In Conclusion

Foreign investments in football has been a boon as well as attracted resistance from local fans. It is up to the investors to chart a clear roadmap for the betterment of the club, keep the local fanbase intact as well grow internationally and at the same time a prudent fiscal management without swaying overboard. The balance is fine requiring a strong understanding of the sport, the local culture and business prospect.

Images: SBI Barcelona