French Football Media Rights: Period of Uncertainty

Couple of days back, the French National Directorate of Control and Management (DNCG) has issued a significant warning to football clubs in Ligue 1, advising them against factoring in television rights for the upcoming season.

This comes at a time when after all the struggles Ligue de Football Professionnel (LFP), the governing body of professional football leagues in France and Monaco, took to secure a broadcast deal in place till a few weeks before the start of 24/25 season. Now, after they secured a deal with DAZN, the agreement looks set to be collapsing as according to L’Équipe, DAZN confirms that they have reached an agreement with the LFP to end their Ligue 1 broadcasting contract.

Now, this certainly does not look good for French football. In this blog we look at the various aspects of the deal and the reason to breakdown, the reliance on broadcast income for clubs and the most important question, what next?

Making of the Deal

DAZN, the sports streaming service, had agreed to show major part , i.e. eight of the nine Ligue 1 games held each matchday as part of a deal worth around €400mn. This was after LFP broke up with its long-time partner Canal+ following a disastrous partnership with Mediapro. It also could not retain Amazon as a broadcast partner.

However, this does not change the agreement with other partner in whole media rights deal, Qatar-owned BeIN Sports.

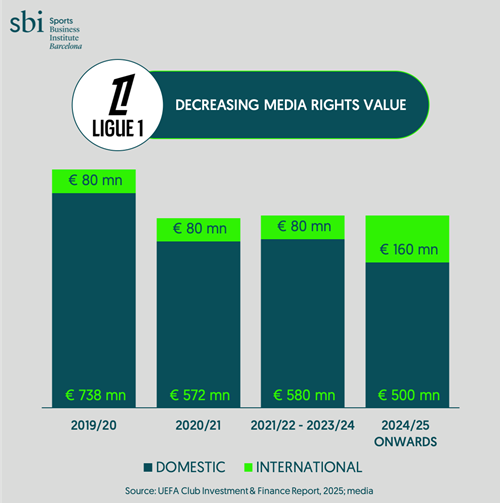

Adding the €40mn for the second-tier Ligue 2 media rights that BeIN Sports pays and further €140mn for international rights, it was supposed to be a total of €700mn for the next few years, at least 2 years till the exit clause lock-in period for DAZN. Well, the lock in period ended early! At €700mn, still LFP had to worry about:

– It is at a 30% lesser value than the original target or anticipation of €1bn for combined rights.

– Ligue 1 domestic media rights value is lower than the previous deal with Amazon & Canal Plus-BeIN by 17%.

– Although the international media rights value has increased but the net total is still lesser than the previous deal value.

Why is DAZN pulling out? Apparently because DAZN has struggled to attract subscribers, with its estimated 500,000 signups done so far. It required to sign 1.5 million subscribers to break even on its investment.

Broadcast Revenue Share

It’s important to understand the overall Ligue 1 revenue structure and the share of broadcast revenue stream.

In 22/23, the aggregated revenue of Ligue 1 clubs was €2.55bn of which broadcast stream contributed €806.3mn or 32% almost equivalent to the commercial revenue stream.

For PSG (who incidentally contributed €807.3mn or 32% of the total league revenue!) the share of broadcast income is 22% and for the rest of clubs, average share is 36% of the total revenue, a substantially high figure.

French Ligue 1 also has a separate revenue head called ‘others’ which is presumably about merchandising, licensing, community grants etc. It contributes significantly in the total revenue, €655.6mn or 26% share. It’s important to consider this because as the broadcast income goes down, this segment would become all the more important.

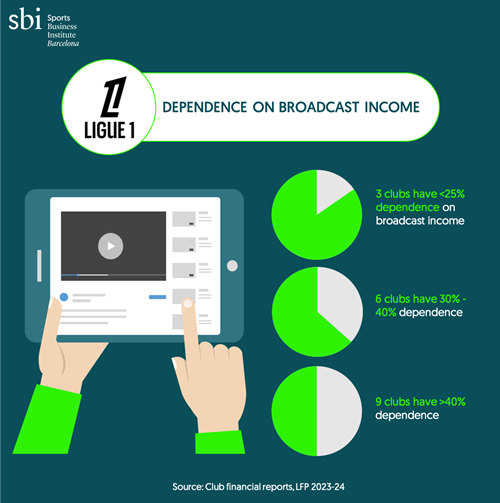

Considering individual club accounts:

– Only three clubs have less than 25% dependence on broadcast income.

– Dependence of six clubs are between 30% – 40%

– Nine clubs have more than 40% dependence on broadcast stream. Except for one club, all others in this segment shows positive net profit/loss in the 23/24 financial results. Thus, any decrease in broadcast income would lead to financial setback for the clubs

Adding to the lower income from broadcasting, there is also the CVC loan to contend with. To those unaware, private equity fund CVC Capital had acquired a 13% stake worth €1.5bn in Ligue 1’s media rights business (in a separately created company).

Way Forward

LFP and DNCG have their work cut out. They have got only two options

– Repair and restore ties with old partners like Canal+ and reset the media rights deal.

– Or venture into direct-to-consumer (DTC) route, which is already being worked upon, as per reports. DAZN has further hinted that it could collaborate with the LFP to help distribute the DTC service, should it start.

Starting a DTC service needs huge investment in backend technology. Question: is LFP ready for DTC?

For the clubs, it’s an altogether separate set of challenges:

– Increased efforts for ‘other revenue’.

– And, so will be for increase in commercial revenue space.

– 25/26 transfer spends will be frugal. More emphasis will be placed on player selling than purchase.

Conclusion

This is a crucial stage for LFP and will require some strong actions. A forced reset probably is a good idea now. With PSG nearing the path to Champions League final and some good on-field performances from Strasbourg, OM fights the gap after Mbappe’s departure from the league.

We are looking forward to see the new rebranded French Ligue 1 & Ligue 2 become stronger

Images & Graphs: SBI Barcelona