In Focus: Oakwell Sports Advisory - The Premier League’s Changing Ownership Landscape

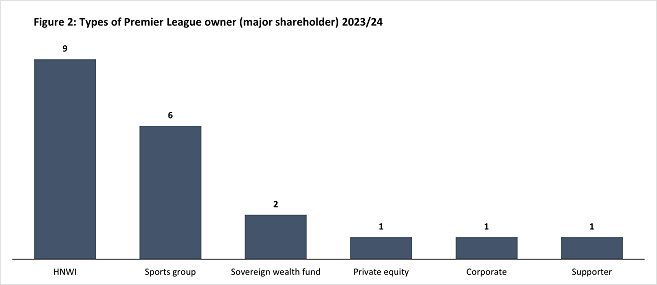

The Premier League’s ownership landscape has changed considerably since the league’s inception in 1992. The most common type of club owner has historically been, and remains, high-net-worth-individuals (HNWIs), although the last 32 years have seen the entry of sports groups, sovereign wealth funds, and private equity funds.

Words: Nic Hamer, Associate, Oakwell Sports Advisory

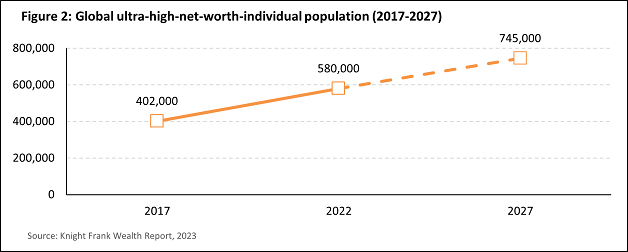

Premier League clubs were originally owned by wealthy domestic individuals. Whilst this is still the case for 5 clubs, others are owned by HNWIs from the US, Greece, and Saudi Arabia. English football clubs have long been viewed as trophy assets for the super-wealthy due to their scarcity and the level of fan interest they attract. As the number of ultra-HNWIs grows globally, in part due to rapid economic development in the Middle East and Asia, demand for English clubs is expected to continue to grow.

HNWIs with corporate and investment experience have often acquired clubs with the aim of creating value through the introduction of greater commercial rigor and operational best-practice. This approach has become more sophisticated over time, with some HNWIs acquiring multiple sports assets and creating sports groups.

Operating under a holding company structure, sports groups allow for the sharing of resources and knowledge across subsidiaries to drive sporting and commercial performance. One example is Fenway Sports Group, founded by commodities trader John Henry, which owns Liverpool, Boston Red Sox, and Pittsburgh Penguins.

The commercialisation of English football and the development of sport into an investment-grade asset class has triggered interest from sports-focused private equity firms, who raise funds from institutional sources (e.g. pension funds, insurance companies) to deploy into football. With a focus on delivering a financial return for their own investors on a defined timeline, private equity firms implement leading management teams, adopt best practice from other industries, and leverage their global network and portfolio companies to accelerate the growth of businesses they acquire.

To date, private equity firms have primarily focused on acquiring elite clubs (e.g. Clearlake and Chelsea) due to their perceived lower risk profile, large fanbases, and global growth opportunities. These funds have been flexible in their approach to football by committing to invest beyond their typical investment horizon of 3-5 years, limiting their use of debt to acquire clubs, and not expecting dividend payouts.

Valuations of English football clubs have continued to rise amidst significant broadcast revenue growth and sustained investor demand so that they are now beyond the reach of many HNWIs and private equity firms. Sovereign wealth funds, such as Saudi Arabia’s Public Investment Fund (PIF) can be less price sensitive. They have a multifaceted football investment thesis which includes developing sport in their own country, diversifying their economies, generating financial return, and cultivating a positive image for their nation globally.

Whilst English football continues to attract a diverse range of investors, there are key themes that attract them all to the sport. Investors that Oakwell advise reference the following industry characteristics as rationale for them seeking to acquire clubs.

Diversified, forecastable revenue streams with room for growth

Broadcast rights are the single greatest revenue driver for most clubs. They are typically contracted long-term, enabling investors to plan beyond the current season and even secure additional financing.

Incoming investors recognise commercial growth potential across broadcast, sponsorship, data, matchday, and merchandising that they hope to unlock through leveraging approaches from US sports and other industries. There remains a significant longer-term opportunity for clubs to recapture value from 3rd parties, such as social media companies, by building and monetising direct relationships with their fans.

Structural change

Investors often perceive opportunity in markets that are affected by positive change. Throughout football’s history, there have been numerous changes to the way the industry is structured, including the creation of the Premier League, multiple revisions of the European Cup/Champions League, and the centralisation of media rights in many domestic leagues. Centralisation of media rights has transformed revenues in Spain and has the potential to do the same in Brazil and Portugal, as they also begin to sell their clubs’ media rights centrally in the next 5 years.

The most striking example of structural change in recent times is the proposed creation of the European Super League. In joining the Super League, elite club owners would have significantly de-risked their investment by removing any possibility that their club doesn’t qualify for the Champions League each season, securing revenues and driving an increase in the value of their assets.

Value appreciation

Whilst most football clubs do not pay dividends, many investors have been able to realise a return through club value appreciation. Chelsea was bought by Roman Abramovich in 2003 for £140m but was valued at £2.5bn when the club was sold in 2022.

North American investors see the potential for further valuation upside when they benchmark European football clubs against US sports franchises such as the NFL’s Washington Commanders, which sold for £4.75bn last year. Changes to the way football operates, such as the imposition of enhanced player salary controls in Europe could accelerate this valuation convergence.

Fan loyalty

The passion of football fans makes the sector more resistant to economic downturns than other industries, with supporters likely to prioritise sports subscription packages or season tickets over other luxury goods in harder economic climates. This can be particularly valuable to financial investors looking to diversify their portfolios away from industries more vulnerable to economic conditions.

Status, prestige, and passion

Football clubs are high-status assets in scarce supply. Wealthy individuals continue to be attracted to the prestige associated with owning clubs and the access to the exclusive network of influential individuals on offer. Wealthy local business people can also be motivated by the notion of giving back to their local community through funding and growing the local football club.

Oakwell expects English football to remain a booming investment market over the next decade. We would not be surprised to see interest from major global brands looking to leverage the global popularity of the Premier League for marketing purposes, as we have seen with brands such as Red Bull in other markets.

New investors, in whatever form they arrive, will continue to drive the football industry forward by bringing new approaches and thinking that allows clubs to capitalise upon the huge commercial, data, and digital opportunities before them.

Oakwell’s experience advising on more than 10 Premier League and EFL club transactions has taught us that it is vital for clubs to seek aligned investors who bring added value and deep respect for a club’s community, history, and existing structures.

Oakwell is currently advising clubs and investors on potential transactions. If you want to find out how Oakwell can help you, please reach out to Nic Hamer at: nh@oakwellsports.com or visit: oakwellsports.com